Posted on March 22, 2023

A new spat in the months-long contract negotiation for US West Coast dockworkers comes at a critical time: Importers and retailers are negotiating service contracts with ocean carriers for the coming year, deciding not only how much cargo they’ll need to move on ships, but also which ports to route it through.

The first public sign that West Coast port labor talks aren’t going well came early Monday when the Pacific Maritime Association, representing carriers and terminal operators, alleged that dockworkers are failing to stagger lunch breaks, causing delays for truckers at terminal gates.

The International Longshore and Warehouse Union, representing 22,000 dockworkers from California to Washington, said trucks can form queues for lots of reasons and accused the PMA of using the queues to influence public opinion.

The two sides had pledged when the talks began in May not to speak to the media during the negotiations and to continue port operations without delays or disruptions. High-level meetings are expected to resume on Tuesday.

As recently as Feb. 23 — the opening of an annual container shipping industry conference that kicks off transoceanic shipping contract season — the ILWU and PMA issued a joint statement saying the talks were progressing and they hoped to reach a deal soon.

Negotiations on longer-term shipping contracts typically wrap up at the end of March or mid-April, and usually go into effect in May, according to Robert Khachatryan, CEO of Southern California-based Freight Right Global Logistics.

“This year it looks like negotiations are moving slower because of the continued drop in rates,” he said. Carriers don’t want to ink deals that would have them moving cargo below cost, and shippers don’t want to lock in rates that are above the spot rate.

This contract season has been messy both for labor talks and shipping rates, and has exacerbated the trend of market share moving from Southern California to the East and Gulf coasts. The Port of Los Angeles saw container volumes plunge 43% in February from a pandemic-era record the year earlier and Long Beach saw a 32% drop.

At a press conference on Friday, LA Executive Director Gene Seroka was hopeful that the delay in shipping contracts could be good for slumping West Coast cargo volumes.

“Many cargo owners want to see a labor deal before they bring more volume back here. So if we get a contract soon, those importers will take notice,” he said.

The fallout may end up much larger than the issue of lunch break timing if it leads to more shippers diverting more cargo away from San Pedro Bay in their contracts.

For now at least, one drayage truck operator says the issues have not put a dent in terminal operations or time truckers spend in lines.

“I haven’t seen a difference. The guys are waiting in line, but I have not seen a drastic change in the amount of time that a truck is waiting for a container,” said Ian Weiland, COO of Junction Collaborative Transports, a drayage provider at the LA and Long Beach ports.

He said the terminals have added additional support at truck gates before and after the lunch hour, which has resulted in an even flow of container appointments in and around the lunch period. Before the lunch break issue someone would process trucks in and out of the terminal during breaks.

“They still had lunch, the trucks just waited inside the terminal. Now the trucks are waiting outside,” Weiland said.

—Laura Curtis in Los Angeles

Charted Territory

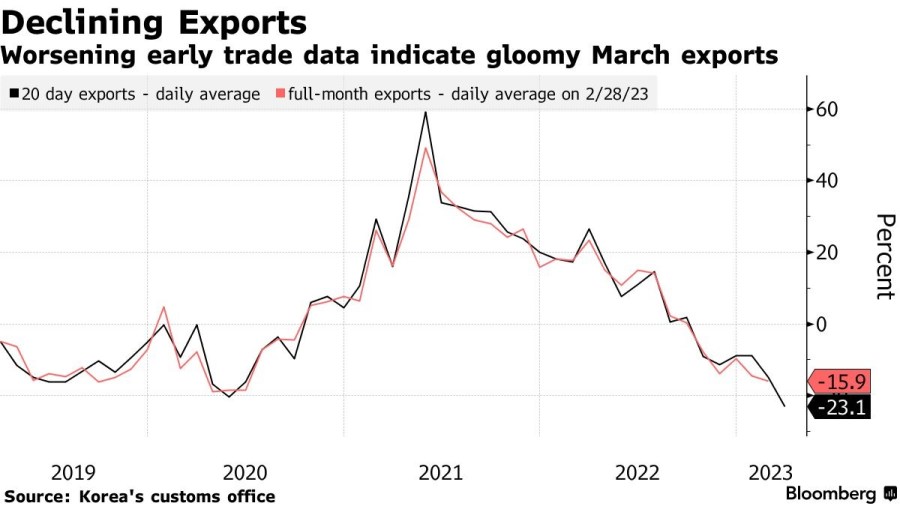

Chip plunge | South Korea’s early trade data showed a deepening slump in exports as global demand for semiconductors remains weak and China’s reopening is yet to generate any boost. Daily shipments decreased 23% on average in the first 20 days of March from a year earlier, the customs office said Tuesday. While total exports fell 17%, chip sales plummeted 45% and shipments to China tumbled 36%.

Today’s Must Reads

- Diversify trade | New Zealand Prime Minister Chris Hipkins urged his nation’s exporters not to rely so heavily on China, saying it’s important for them to diversify in an uncertain world.

- Running strong | Auto sales in Europe increased for a seventh straight month, aided by strong growth in the UK and Spain and improving supply chains. Separately, investor sentiment in Germany’s economy fell for the first time in six months.

- Bonus green | Soon after giving its employees a bumper 50-month bonus, Taiwan’s Evergreen Marine is handing out another hefty reward as it reaps the gains of a now-fading shipping boom.

- Brexit vote | Northern Ireland’s Democratic Unionist Party said its lawmakers will unanimously vote against Rishi Sunak’s post-Brexit deal for the region, in a significant blow to the UK prime minister.

- Subsidy spat | President Joe Biden’s $370 billion plan to support businesses leading the transition to a low-carbon economy has riled some of America’s largest trading partners, who say the measures unfairly benefit US companies and harm free trade. Now the European Union is striking back

- Electric shock | In the world of gasoline cars, Japan’s automakers are king. Toyota has been the world’s No. 1 car company for the past three years, while Honda and Nissan remain global best sellers. But as the transition to electric vehicles accelerates, the Japanese giants are facing stiffer competition and nowhere is the threat more apparent than in China.

On the Bloomberg Terminal

- China responds | The Netherlands risks damaging economic relations with China if it carries on with the planned export restrictions on chipmaking machines, Beijing’s ambassador in the Hague warned in an interview with a Dutch newspaper.

- Heavier loads | Relative demand in North America’s spot trucking market tightened in the week ended March 17, with a 2.2% increase in Truckstop’s Market Demand Index, according to Bloomberg Intelligence.

- Run SPLC after an equity ticker on Bloomberg to show critical data about a company’s suppliers, customers and peers.

- On the Bloomberg Terminal, type NH FWV for FreightWaves content.

- Use the AHOY function to track global commodities trade flows.

- Click HERE for automated stories about supply chains.

- On the Bloomberg Terminal, type NH FWV for FreightWaves content.

- See BNEF for BloombergNEF’s analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.