Posted on February 18, 2019

Virtu Financial LLC purchased a new position in Great Lakes Dredge & Dock Co. (NASDAQ:GLDD) in the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 34,553 shares of the construction company’s stock, valued at approximately $229,000. Virtu Financial LLC owned 0.06% of Great Lakes Dredge & Dock at the end of the most recent reporting period.

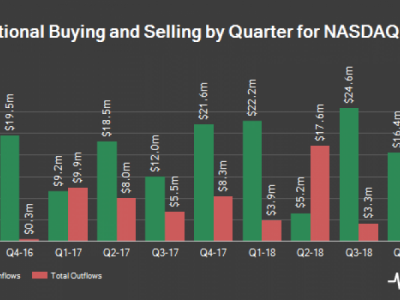

Several other institutional investors also recently bought and sold shares of GLDD. Walthausen & Co. LLC bought a new stake in Great Lakes Dredge & Dock during the third quarter valued at $14,678,000. Essex Investment Management Co. LLC lifted its stake in Great Lakes Dredge & Dock by 419.7% during the third quarter. Essex Investment Management Co. LLC now owns 325,593 shares of the construction company’s stock worth $2,019,000 after purchasing an additional 262,946 shares during the last quarter. TCW Group Inc. lifted its stake in Great Lakes Dredge & Dock by 45.3% during the third quarter. TCW Group Inc. now owns 807,995 shares of the construction company’s stock worth $5,010,000 after purchasing an additional 251,752 shares during the last quarter. BlackRock Inc. lifted its stake in Great Lakes Dredge & Dock by 5.5% during the second quarter. BlackRock Inc. now owns 3,950,370 shares of the construction company’s stock worth $20,739,000 after purchasing an additional 205,172 shares during the last quarter. Finally, Renaissance Technologies LLC lifted its stake in Great Lakes Dredge & Dock by 171.1% during the third quarter. Renaissance Technologies LLC now owns 118,200 shares of the construction company’s stock worth $733,000 after purchasing an additional 74,600 shares during the last quarter. 75.51% of the stock is owned by hedge funds and other institutional investors.

Shares of NASDAQ:GLDD opened at $7.37 on Friday. The company has a current ratio of 1.56, a quick ratio of 1.33 and a debt-to-equity ratio of 1.57. The stock has a market cap of $442.36 million, a P/E ratio of -27.30 and a beta of 0.62. Great Lakes Dredge & Dock Co. has a 1 year low of $4.25 and a 1 year high of $7.94.

In other Great Lakes Dredge & Dock news, Director Ryan Levenson sold 125,000 shares of Great Lakes Dredge & Dock stock in a transaction that occurred on Thursday, December 13th. The stock was sold at an average price of $7.53, for a total transaction of $941,250.00. Following the sale, the director now directly owns 35,816 shares of the company’s stock, valued at approximately $269,694.48. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Insiders own 9.13% of the company’s stock.

Several research analysts have recently commented on GLDD shares. BidaskClub downgraded Great Lakes Dredge & Dock from a “hold” rating to a “sell” rating in a report on Tuesday, October 23rd. ValuEngine downgraded Great Lakes Dredge & Dock from a “buy” rating to a “hold” rating in a report on Tuesday. Finally, Zacks Investment Research upgraded Great Lakes Dredge & Dock from a “hold” rating to a “strong-buy” rating and set a $7.75 price objective on the stock in a report on Wednesday, November 7th. One analyst has rated the stock with a hold rating, two have issued a buy rating and one has issued a strong buy rating to the company’s stock. Great Lakes Dredge & Dock has a consensus rating of “Buy” and a consensus target price of $7.88.

Great Lakes Dredge & Dock Profile

Great Lakes Dredge & Dock Corporation provides dredging services in the United States and internationally. It operates through two segments, Dredging, and Environmental & Infrastructure. The Dredging segment is involved in capital dredging that consists of port expansion projects, coastal restoration and land reclamations, trench digging for pipelines, tunnels and cables, and other dredging related to the construction of breakwaters, jetties, canals, and other marine structures.

Source: Fairfield Current