Posted on February 4, 2019

Virtu Financial LLC acquired a new stake in Great Lakes Dredge & Dock Co. (NASDAQ:GLDD) during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 34,553 shares of the construction company’s stock, valued at approximately $229,000. Virtu Financial LLC owned approximately 0.06% of Great Lakes Dredge & Dock at the end of the most recent quarter.

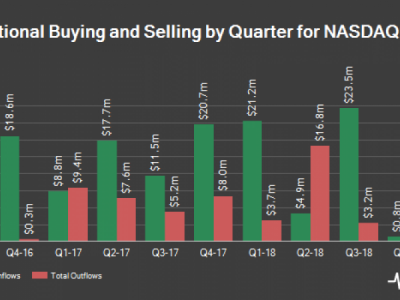

Other institutional investors and hedge funds have also recently made changes to their positions in the company. Schwab Charles Investment Management Inc. lifted its holdings in shares of Great Lakes Dredge & Dock by 12.2% during the 2nd quarter. Schwab Charles Investment Management Inc. now owns 312,890 shares of the construction company’s stock valued at $1,643,000 after buying an additional 34,120 shares during the period. BlackRock Inc. raised its holdings in Great Lakes Dredge & Dock by 5.5% during the second quarter. BlackRock Inc. now owns 3,950,370 shares of the construction company’s stock valued at $20,739,000 after acquiring an additional 205,172 shares during the period. Essex Investment Management Co. LLC grew its position in shares of Great Lakes Dredge & Dock by 419.7% during the third quarter. Essex Investment Management Co. LLC now owns 325,593 shares of the construction company’s stock valued at $2,019,000 after purchasing an additional 262,946 shares in the last quarter. Russell Investments Group Ltd. grew its position in shares of Great Lakes Dredge & Dock by 0.5% during the third quarter. Russell Investments Group Ltd. now owns 3,675,275 shares of the construction company’s stock valued at $22,783,000 after purchasing an additional 17,159 shares in the last quarter. Finally, Hodges Capital Management Inc. purchased a new position in shares of Great Lakes Dredge & Dock during the third quarter valued at about $429,000. Institutional investors and hedge funds own 75.75% of the company’s stock.

Several research analysts recently commented on GLDD shares. BidaskClub lowered Great Lakes Dredge & Dock from a “strong-buy” rating to a “buy” rating in a research report on Wednesday. Zacks Investment Research raised shares of Great Lakes Dredge & Dock from a “hold” rating to a “strong-buy” rating and set a $7.75 price target for the company in a research note on Wednesday, November 7th. Two investment analysts have rated the stock with a buy rating and two have issued a strong buy rating to the company’s stock. The company has an average rating of “Strong Buy” and an average target price of $7.88.

Shares of GLDD traded down $0.03 during trading hours on Friday, reaching $7.04. 25,214 shares of the company traded hands, compared to its average volume of 240,349. The firm has a market capitalization of $441.11 million, a PE ratio of -26.07 and a beta of 0.71. The company has a debt-to-equity ratio of 1.57, a current ratio of 1.56 and a quick ratio of 1.33. Great Lakes Dredge & Dock Co. has a 12-month low of $4.15 and a 12-month high of $7.94.

Great Lakes Dredge & Dock (NASDAQ:GLDD) last announced its quarterly earnings data on Tuesday, November 6th. The construction company reported $0.18 earnings per share for the quarter, beating analysts’ consensus estimates of $0.03 by $0.15. The firm had revenue of $204.32 million for the quarter, compared to analyst estimates of $199.25 million. Great Lakes Dredge & Dock had a negative net margin of 1.07% and a negative return on equity of 0.73%. The business’s quarterly revenue was up 25.1% compared to the same quarter last year. During the same period in the previous year, the company earned ($0.08) earnings per share. As a group, research analysts anticipate that Great Lakes Dredge & Dock Co. will post 0.11 EPS for the current fiscal year.

In other news, Director Ryan Levenson sold 125,000 shares of the business’s stock in a transaction on Thursday, December 13th. The shares were sold at an average price of $7.53, for a total transaction of $941,250.00. Following the sale, the director now directly owns 35,816 shares of the company’s stock, valued at $269,694.48. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 9.13% of the stock is owned by insiders.

About Great Lakes Dredge & Dock

Great Lakes Dredge & Dock Corporation provides dredging services in the United States and internationally. It operates through two segments, Dredging, and Environmental & Infrastructure. The Dredging segment is involved in capital dredging that consists of port expansion projects, coastal restoration and land reclamations, trench digging for pipelines, tunnels and cables, and other dredging related to the construction of breakwaters, jetties, canals, and other marine structures.

Source: Fairfield Current