Posted on January 29, 2019

By Seeking Alphaa,Thank you, Amy, and good morning. I’d like to begin today by thanking our global team for delivering an outstanding year in 2018. It was the best profit per share performance in our company’s history, which allowed us to return $5.8 billion of capital to shareholders. In 2018 we remained focused on making our customers more successful and executing our enterprise strategy, which centers around achieving long term profitable growth through operational excellence and investing in services and expanded offerings.

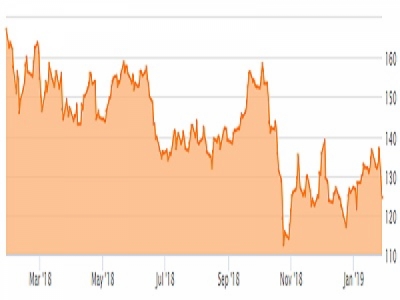

Revenue for the year was up 20% to $54.7 billion as favorable economic conditions drove growth across many of our end markets. We delivered record adjusted profit per share of $11.22 and strong operating cash flow of $6.3 billion, which allowed us to repurchase $3.8 billion of company stock, raise the dividend by 10% and make a discretionary pension contribution of $1 billion. 2018 marks the 25th consecutive year we paid higher dividends to our shareholders, earnings us recognition as a member of the elite Aristocrat’s Dividend Fund.

Our fourth quarter adjusted operating margin was 13.8%. This was lower than our expectations and was impacted primarily by right-offs at Cat Financial and higher than expected material and freight costs.

READ FULL ARTICLE HERE